June means it's time for your Mid-Year Financial Checklist

/What should you be looking at in June?

A mid-year financial check-in is a crucial practice for maintaining and improving one’s financial health. Typically this process is helpful during the month of June so that you can do a thorough review of your finances, including income, expenses, savings, and investments, to ensure you are on track with your annual financial goals.

By taking the time to assess your financial situation mid-year, you can make necessary adjustments, correct any deviations, and reinforce positive habits that will help you achieve your long-term financial objectives. This proactive approach allows for a more manageable and less stressful end-of-year financial review.

Mid-Year Checklist

Budget Review

· Compare actual income and expenses against your budget.

· Identify categories where you overspent or underspent.

· Adjust budget allocations as needed for the remaining months.

Income Assessment

· Verify all sources of income for accuracy.

· Consider any changes in income, such as bonuses, raises, or additional income streams.

· Plan for any expected changes in income for the rest of the year.

Expense Analysis

· Review all regular and recurring expenses.

· Identify any new or unexpected expenses that have occurred.

Debt Management

· List all outstanding debts, including credit cards, loans, and mortgages.

· Check balances, interest rates, and monthly payments.

· Explore options for refinancing or consolidating high-interest debt.

· Develop or update a repayment plan to stay on track.

Credit Health Check

· Obtain a copy of your credit report from all three major bureaus (Equifax, Experian, TransUnion).

· Check for any errors or signs of identity theft.

· Confirm all open accounts are accurate and hard inquiries were approved.

· Review your credit score and take steps to improve it if necessary.

Savings Review

· Evaluate the balance of your emergency fund.

· Ensure you have at least three to six months of living expenses saved.

· Review if cash on hand is in a high-yield checking or savings account.

· Determine if cash in excess of the emergency fund should be invested.

· Confirm you are taking advantage of employer funded savings such as an employer retirement plan match or HSA match.

· Review savings goals for short-term and long-term objectives.

· Adjust savings plan to meet these goals by year-end.

Investment Portfolio Review

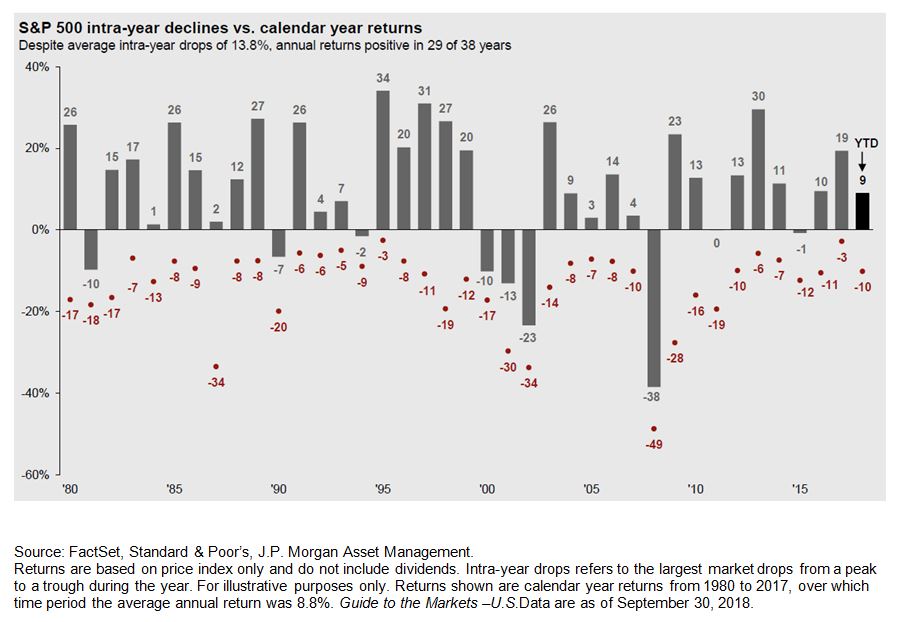

· Assess the performance of your investments.

· Review asset allocation and rebalance your portfolio if necessary.

· Check for any changes in risk tolerance or investment strategy.

· Consider increasing contributions to retirement accounts if possible.

Insurance Coverage

· Review all insurance policies (health, auto, home, life, umbrella, disability, etc.).

· Ensure coverage is adequate and up-to-date.

· Compare policies to find better rates or coverage if needed.

Tax Planning

· Review the first half of the year's income and tax withholdings.

· Estimate your tax liability for the year.

· Make any necessary adjustments to withholdings or estimated tax payments.

· If you need to make estimates, determine if estimates should be based on the prior year safe harbor or current year estimated liability.

· Review for strategic opportunities to utilize Roth IRA contributions or conversions.

Financial Goals Update

· Review your financial goals set at the beginning of the year.

· Assess progress towards each goal.

· Adjust timelines or strategies for achieving these goals if needed.

Financial Documentation

· Organize financial documents and statements.

· Ensure important documents are accessible and securely stored.

· Consider going paperless if it helps with organization.

Meet with your Advisor

· Schedule a meeting with your Advisor

· Discuss any major life changes that could affect your financial plan.

· Seek guidance on any complex financial decisions or adjustments.

This holistic review ensures that your financial plans remain adaptable to any changes that may arise throughout the rest of the year. Reminder to keep an open line of communication with your Advisor for any changes in your financial situation.

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Adviser cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Gilbert & Cook does not provide tax or legal or accounting advice, and nothing contained in these materials should be taken as such. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. As always please remember investing involves risk and possible loss of principal capital and past performance does not guarantee future returns; please seek advice from a licensed professional. Gilbert & Cook is a Registered Investment Adviser. SEC Registration does not constitute an endorsement of Gilbert & Cook by the SEC nor does it indicate that Gilbert & Cook has attained a particular level of skill or ability. Advisory services are only offered to clients or prospective clients where Adviser and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Adviser unless a client service agreement is in place.