Coping With Market Volatility

/During periods of economic uncertainty, financial markets are often characterized by wide swings in market value. Such “market volatility,” with prices sharply rising and falling, is a reflection of changeable investor sentiment as well as more substantive economic or political events. Even during more stable times, financial markets will fluctuate, although price movements tend to be more moderate. By their very nature, financial markets rise and fall constantly, with an ever-present potential for gain or loss.

How to Cope with Market Volatility

Avoid an Emotional Response

When markets fall sharply, some investors panic, sell their holdings, and shift assets into perceived "safer" investments. This emotion-driven decision-making can turn paper losses into real ones and limit gains if markets recover. Similarly, buying when the markets are “hot” can lead to buying high and selling low.

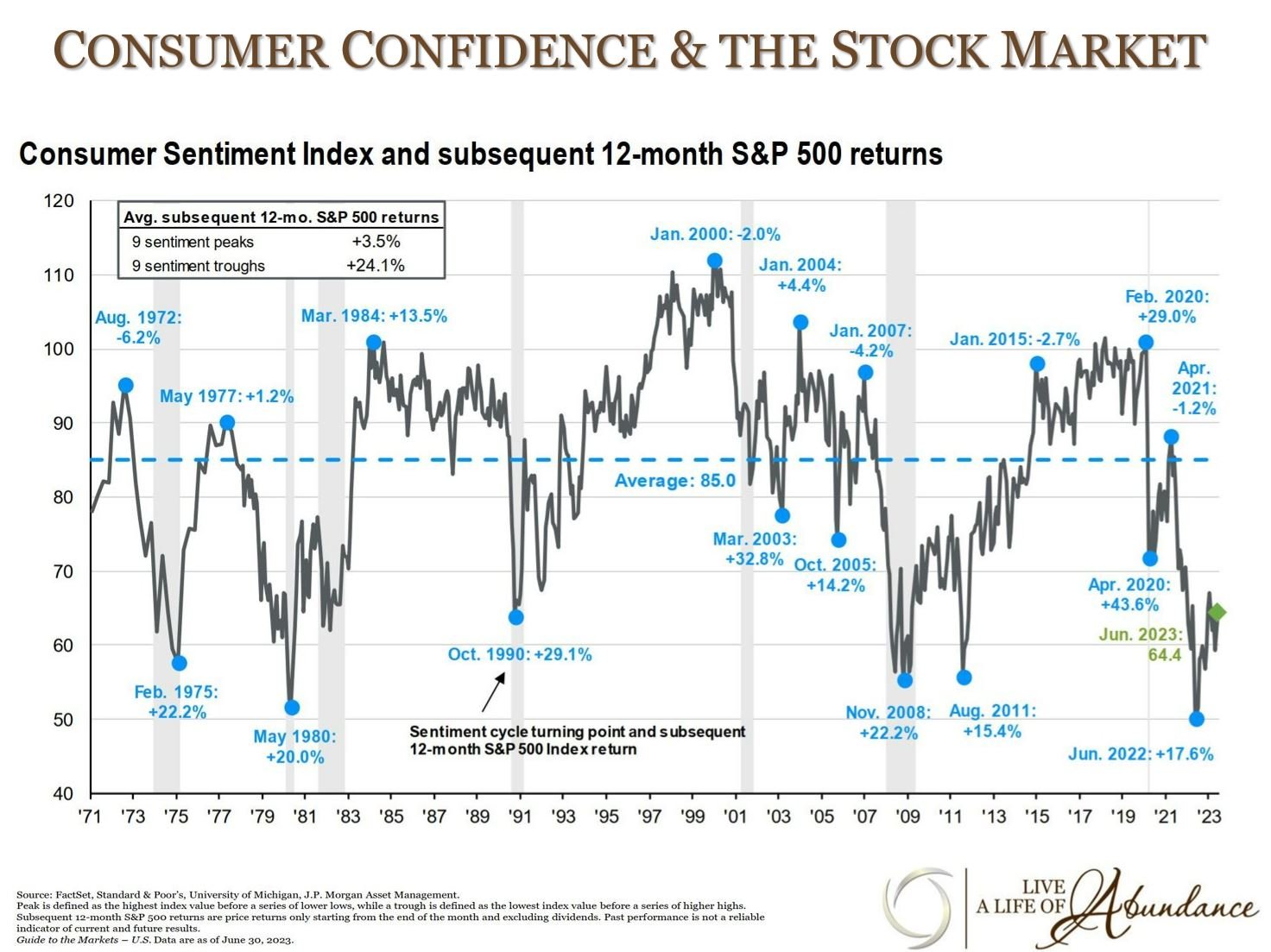

"Timing" the Market

Some investors try to buy low and sell high, but identifying market tops and bottoms is nearly impossible. As the Wall Street phrase goes, “No one rings a bell.” While market timing may sound logical, no system has consistently and accurately identified market peaks and troughs.

Diversify Your Portfolio - Asset Allocation

Asset allocation involves spreading investments across different asset types to manage risk. Stocks, bonds, cash equivalents, and tangible assets like real estate or gold are often included in a well-diversified portfolio. This strategy helps smooth out volatility since different assets perform differently over time.

Regularly Review Your Investment Strategy

Portfolios should be adjusted based on changing goals, market conditions, and economic factors. A well-balanced strategy accounts for liquidity needs, risk tolerance, and tax considerations. Rebalancing ensures the portfolio stays aligned with financial objectives.

Take a Long-Term View

Historically, equity markets have trended upward despite periodic declines. Investors should focus on long-term goals and keep a portion of their portfolio in liquid assets for short-term needs, allowing the rest to grow.

Automatic Investing - Dollar Cost Averaging

Investing a fixed amount at regular intervals, known as dollar cost averaging, helps manage market fluctuations. This strategy buys more shares when prices are low and fewer when prices are high, but it does not guarantee profits or protect against losses.

Remember… You have a team behind you.

Regardless of market conditions, working with your Abundance Team at Gilbert & Cook can help provide clarity in times of uncertainty and give you the confidence to make important wealth decisions. Always feel free to contact your Advisor if you have any questions or concerns.

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Adviser cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Gilbert & Cook does not provide tax or legal or accounting advice, and nothing contained in these materials should be taken as such. To determine which investments may be appropriate for you, consult your financial advisor prior to investing. As always please remember investing involves risk and possible loss of principal capital and past performance does not guarantee future returns; please seek advice from a licensed professional. Gilbert & Cook is a Registered Investment Adviser. SEC Registration does not constitute an endorsement of Gilbert & Cook by the SEC nor does it indicate that Gilbert & Cook has attained a particular level of skill or ability. Advisory services are only offered to clients or prospective clients where Adviser and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Adviser unless a client service agreement is in place.