Spring cleaning season may be coming toward an end as we head into summer, but did you actually take a look at your finances as part of your spring cleaning?

It’s that time of year again, where people start to open their windows, dust out their closets and start to organize and “tidy up”. Whether it’s deep cleaning the house, garage, yard, or office, it’s about prioritizing. All this spring-cleaning buzz got me to thinking, what are some of the spring-cleaning items people should think about when it comes to their finances.

Often times we get busy in the other things we have to do in life, be it work, family, kids’ activities or social events, whatever it is we put those things in front of less important things like our finances. Wait -I just said our finances are less important than all those things? Well to some degree I do think that is true, because living your life of abundance goes much deeper than your finances. BUT in 10, 15, 20, 25, 30 years, we are all going to want to retire and spend even more time on the afore mentioned things. So now we should spend time on getting our financial lives organized and prepared for our future goals.

Where do we start?

TAXES

A good time to start thinking about these spring-cleaning finance items could start right after you file your taxes. After you see how your previous year taxes have shaken out, you can make any important changes for the following year. This is a good opportunity to update your tax withholdings or increase your 401k contributions ($19,000 employee max with an additional $6,000 for over 50 catch-up).

Speaking of 401ks, if you’re a business owner, you should be thinking about what type of retirement plan is right for you and your employees. A 401k can be a great tax and retention tool for the business. After tax season, It’s also a good time to start thinking about the other things you can do to reduce your taxable income for the year or even put pencil and paper (yes it’s ok to still use those in this tech world) to your charitable giving strategy for the remainder of the year.

PERSONAL CREDIT

Next Up – Credit Check

During your spring financial clean-up, you should think about running your first of three free annual credit reports for the year available to you by the credit bureaus, Experian, TransUnion, and Equifax. (click link for more info: https://www.ftc.gov/faq/consumer-protection/get-my-free-credit-report).

Looking at your credit report will allow you to see what current credit cards and credit lines are open/closed in your name, what personal information the credit bureaus have like addresses reported, telephone numbers, and employment data, and also current inquiries on your credit which you should be familiar with the names showing up.

INSURANCE

Now let’s start thinking ahead to fall benefit enrollments.

It seems like this always sneaks up on us, however, if we start thinking about it early, it should put us in a good spot to make good decisions when the enrollment window opens. Make sure you are utilizing the benefits right for your family, whether it’s utilizing an HSA account, flex spending accounts, increasing your group term life insurance, or adding something like disability coverage, it’s important to maximize those benefits.

Insurance coverage, yes, I mentioned we should be thinking about it before enrollment period, but it’s also good to review your overall insurance coverage. Have you had any major life events over the last year which might mean a change to coverage is needed like a big raise, having a new baby, bought a new house, got married, or even retired? All these life events are good reasons to revisit your insurance plan, but I think it’s also just a good job to think about it annually during your financial spring cleaning.

SPENDING

Now I know you’re waiting for me to write about something fun, so how about I throw one out that we all care about tracking and monitoring…our monthly budget!

Ok, we all know putting together (and more importantly, following) a budget isn’t the most enjoyable past time; however, it’s a place we can save a few bucks. Here are a few easy ones: have you looked at different cell phone carrier options lately or compared cable/satellite tv options? How about looked at your home and car insurance premiums? Looking at those three items during the spring cleaning could help save $100s of dollars annually. That’s more money to spend on lattes! (Oh wait, think about cutting that daily drink at your favorite coffee shop as well.)

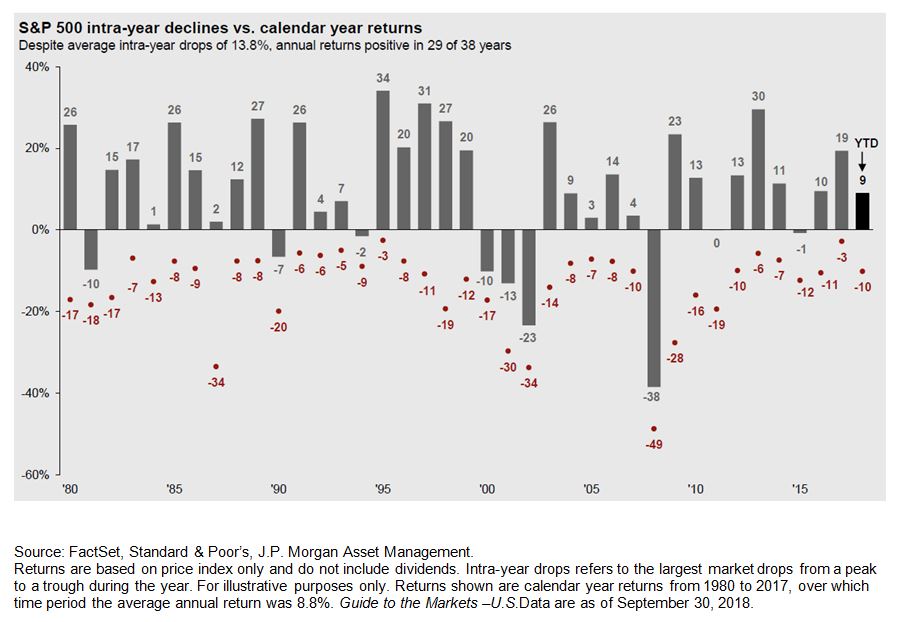

Wait did I just say you could save $100s of dollar annually? Ok, maybe that doesn’t get a lot of people too excited, so let’s talk about something that can save or make you thousands of dollars annually. I’m talking about having a coordinated allocation for your investments. Hang with me here, I’m not saying you have to do this on your own but working with a good financial advisor can help ensure this part of your spring financial cleaning is done. I’m sure lots of us hire someone to do our actual spring cleaning at our house, so there’s nothing wrong with doing the same here with your investments.

ESTATE PLANNING

Lastly, and this thing is probably more like the basement which only gets cleaned every 5-10 years during spring cleaning and it’s ensuring your estate planning documents are up to date with your wishes.

I know most of you are thinking, now where did I put those things again? Make sure they are still relevant with current legislation and the people you wrote into the documents are still willing and/or able to handle their duties. I definitely saved one of the more important things for last on purpose (I was hoping you would read the whole blog). This is something that’s easily overlooked, and we all know a friend or family member who forgot to update their documents or worse yet, didn’t have any in place. Blow the dust off the documents and give them a read or contact a good attorney to help in your review.

I’m sure you’ve had enough of my rambling at this point, but let’s recap the Financial Spring Cleaning items quick:

- Make tax adjustments as needed whether it’s withholding or 401k contributions

- Run your first of three FREE annual credit reports

- Start thinking about fall benefit enrollments

- Review current insurance coverage

- Update your monthly budget

- Have a plan for your investments

- And finally, make sure your estate planning documents follow your current wishes.

Ok, now what are you waiting for, get a move on it! Please contact our Gilbert & Cook team if we can help answer any of the questions on this honey-do-list.

Author: Jerit Tripp, Advisor